Introduction

In 2025, financial literacy and smart money management are more important than ever. Thankfully, technology has made it easier to budget, save, and invest with just a few taps on your phone. The right finance app can act as your personal advisor, helping you stay on track and grow your wealth.

Here are the Top 4 finance apps in 2025 that you should have on your device.

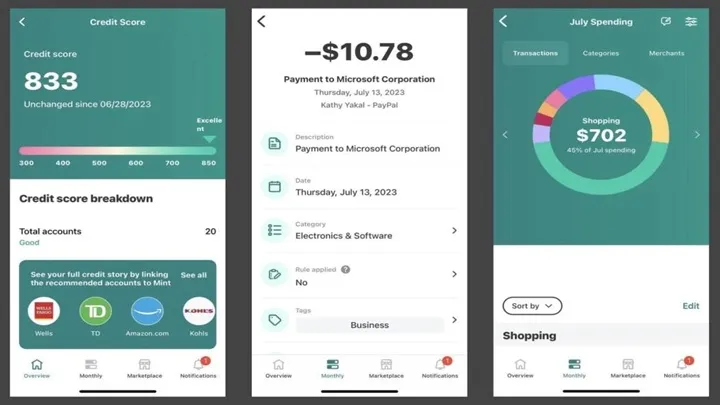

1. Mint – Budgeting Made Simple

Mint remains one of the most popular budgeting apps thanks to its simplicity and automation.

Key benefits:

- Syncs with your bank accounts for real-time tracking.

- Automatically categorizes expenses.

- Provides insights on spending habits.

- Sends bill reminders to avoid late fees.

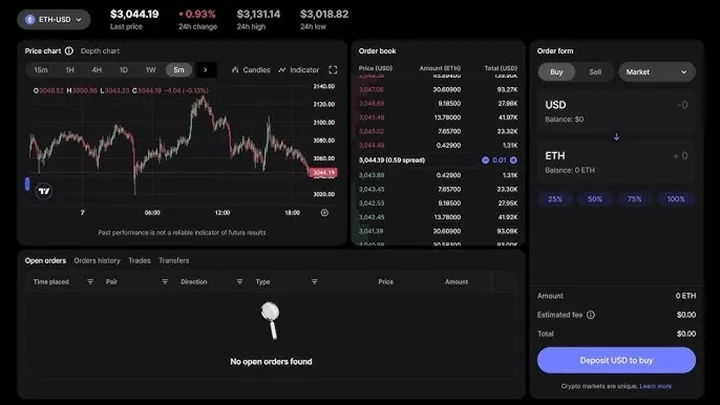

2. Robinhood – Easy Investing for Everyone

Robinhood makes investing accessible, even for beginners.

Key benefits:

- Commission-free trading for stocks and crypto.

- User-friendly interface for new investors.

- Educational tools to learn about markets.

- Portfolio tracking and real-time market updates.

3. Revolut – The Digital Banking App

Revolut is more than a bank—it’s a financial ecosystem.

Key benefits:

- Low-cost international transfers.

- Multi-currency accounts for travelers.

- Tools for budgeting and expense analysis.

- Options for investing in stocks and crypto.

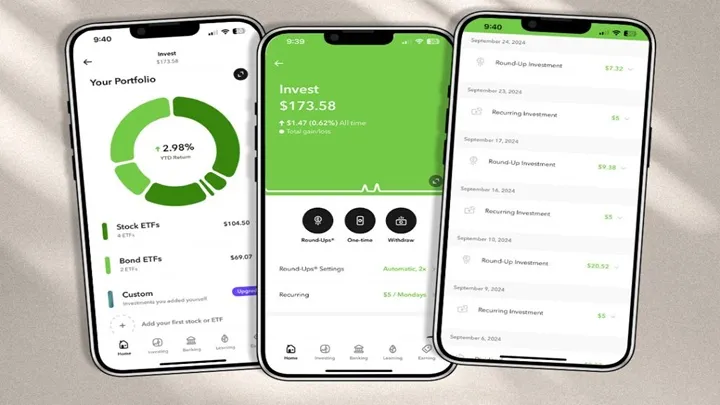

4. Acorns – Investing Your Spare Change

Acorns helps beginners grow wealth passively by investing small amounts.

Key benefits:

- Rounds up purchases and invests spare change.

- Automated investment portfolios.

- Retirement and savings account options.

- Simple and hands-off approach to investing.

Conclusion

From budgeting with Mint, to investing with Robinhood and Acorns, and banking with Revolut, these apps make money management in 2025 smarter and easier than ever.

Whether you’re a beginner or an experienced investor, these finance apps can help you stay in control and plan for a better financial future.