Introduction

Managing money wisely is more important than ever in 2025. Finance apps are helping people budget, save, and even invest with just a few taps on their smartphones. From tracking expenses to growing wealth, these apps empower users to take control of their financial future.

Here are the Top 4 finance apps in 2025 that stand out.

1. Mint – Budgeting Made Simple

Mint is one of the most popular apps for personal finance management.

Key benefits:

- Automatically tracks spending and categorizes expenses.

- Creates personalized budgets.

- Provides credit score monitoring.

- Free and easy to use.

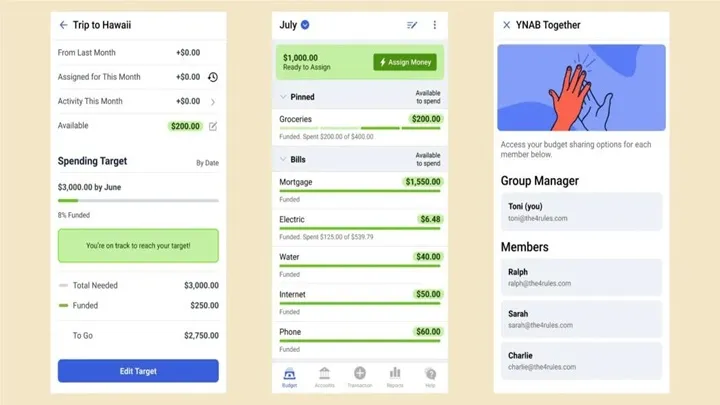

2. YNAB (You Need a Budget) – Take Control of Spending

YNAB focuses on proactive budgeting to help users save more.

Key benefits:

- Zero-based budgeting approach.

- Goal tracking for savings and debt payoff.

- Real-time syncing across devices.

- Active community and tutorials.

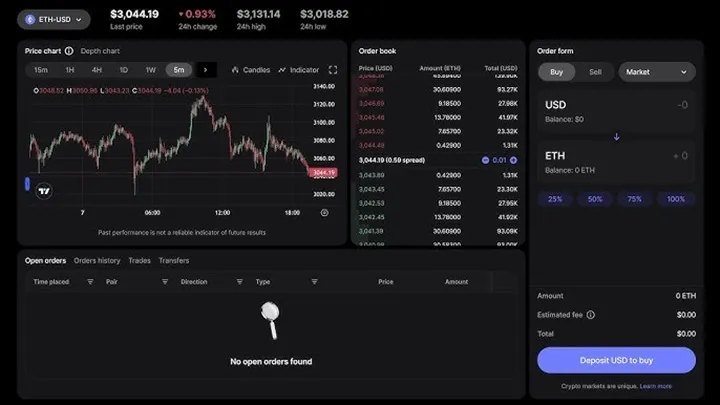

3. Robinhood – Easy Stock Investing

Robinhood makes investing in stocks and crypto simple.

Key benefits:

- Commission-free trades.

- Supports stocks, ETFs, and cryptocurrencies.

- Intuitive interface for beginners.

- Real-time market updates.

4. Revolut – All-in-One Finance App

Revolut combines banking, payments, and investments.

Key benefits:

- Multi-currency accounts with global transfers.

- Budgeting and spending insights.

- Access to crypto and stock trading.

- Virtual cards for secure online payments.

Conclusion

From budget tracking on Mint, saving strategies on YNAB, investing with Robinhood, to all-in-one financial tools on Revolut, these apps are revolutionizing money management in 2025.

Whether you’re saving, investing, or just trying to stay on budget, these tools will help you achieve financial freedom.