In today’s fast-paced digital economy, efficient financial management is the backbone of every successful business. Whether you’re a freelancer, entrepreneur, or running a small-to-medium-sized company, the ability to create invoices quickly, track payments, and maintain accurate billing records is non-negotiable.

Traditional paper invoicing is outdated, slow, and prone to human errors. Clients demand instant, professional, and digital invoices that can be paid seamlessly online. This is where invoice & billing apps come in.

These apps don’t just help with invoices—they integrate payments, automate reminders, manage recurring billing, and provide insightful reports. The right choice ensures smoother client relationships, faster payments, and less financial stress.

Below, we explore the top apps for invoice & billing in 2025, highlighting their features, benefits, and best use cases.

1. QuickBooks Online – The Industry Standard

QuickBooks Online has long been considered the gold standard for business financial tools. Its invoicing capabilities are robust and tightly integrated with accounting.

- Key Features:

- Highly customizable invoices with branding

- Automated billing cycles and reminders

- Payment acceptance via credit cards, ACH, and PayPal

- Tax calculation and reporting

- Best For:

- Small-to-medium businesses that want an all-in-one financial platform.

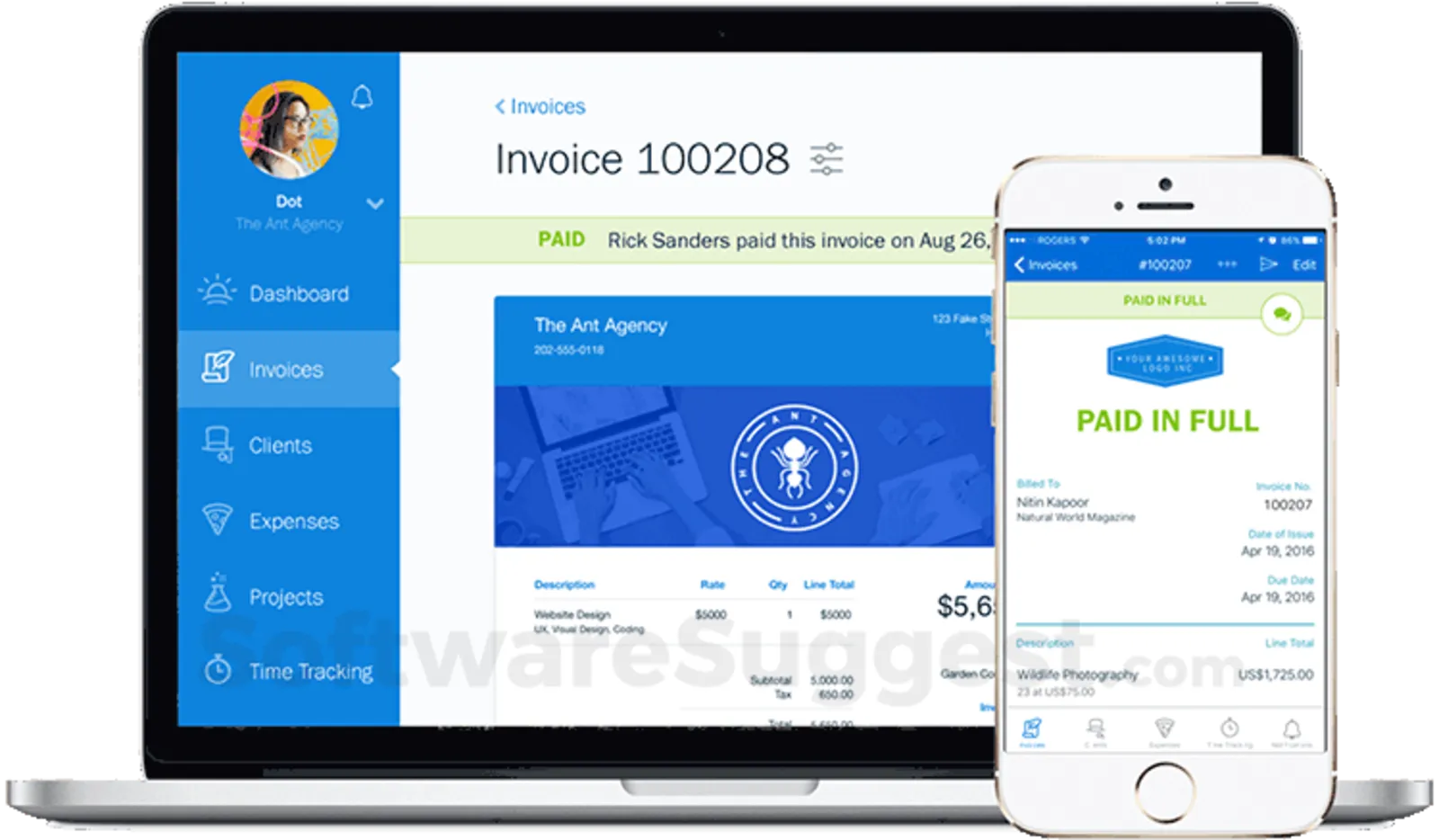

2. FreshBooks – User-Friendly and Intuitive

FreshBooks is designed to simplify billing for freelancers, startups, and small teams.

- Key Features:

- Drag-and-drop invoice builder

- Integrated expense and time tracking

- Online payments with Stripe and PayPal

- Late fee reminders

- Best For:

- Freelancers and consultants who value ease of use and professional invoicing.

3. Zoho Invoice – Free and Powerful

Zoho Invoice is one of the rare full-featured apps available completely free.

- Key Features:

- Invoice templates in multiple languages

- Support for global currencies

- Client self-service portal

- Recurring billing

- Best For:

- Startups or entrepreneurs who need premium invoicing without the cost.

4. Wave Invoicing – No-Cost Simplicity

Wave is another popular free invoice app that’s simple but effective.

- Key Features:

- Unlimited invoicing with customization

- Recurring payments

- Integration with Wave’s free accounting suite

- Option to accept credit card and bank payments

- Best For:

- Small businesses or side hustlers looking for cost-effective tools.

5. Invoice2go – Mobile-Focused Invoicing

Invoice2go is a highly mobile-friendly invoicing solution.

- Key Features:

- Create invoices in seconds from a smartphone

- Accept payments via multiple gateways

- Invoice status tracking in real time

- Built-in financial reporting

- Best For:

- Contractors and professionals who work on the go.

6. Xero – Scalable for Growing Companies

Xero offers advanced financial tools with a focus on scalability.

- Key Features:

- Automated invoice follow-ups

- Multi-currency support

- Integration with 1,000+ business apps

- Expense management and payroll

- Best For:

- Growing companies that need comprehensive business finance features.

7. PayPal Invoicing – Trusted Worldwide

PayPal’s invoicing feature leverages its global reputation.

- Key Features:

- Invoice creation directly within PayPal

- Global currency and language support

- Secure instant payments

- Integrated transaction records

- Best For:

- Freelancers and businesses with international clients.

8. Square Invoices – Great for Retail & Service Industries

Square is well-known for point-of-sale systems but also excels in invoicing.

- Key Features:

- Custom invoices integrated with Square POS

- Online and in-person payments

- Automatic receipts and reminders

- Detailed reporting dashboard

- Best For:

- Retailers and service providers who already use Square ecosystem tools.

9. AND.CO by Fiverr – Freelancers’ All-in-One Tool

AND.CO combines invoicing with contracts and client management.

- Key Features:

- Professional one-click invoices

- Built-in contracts and proposals

- Time tracking linked to billing

- Automated payment reminders

- Best For:

- Freelancers who want a complete client management system.

10. Billdu – Affordable and Straightforward

Billdu provides a cost-friendly invoicing solution that’s fast and easy.

- Key Features:

- Templates ready in seconds

- Expense tracking with receipt scanning

- Cross-platform functionality (mobile & web)

- Client database for history tracking

- Best For:

- Startups and small businesses needing quick, easy billing.

Benefits of Using Invoice & Billing Apps

Switching to modern billing apps brings significant advantages:

1. Save Time

Automated templates, recurring invoices, and reminders reduce manual work.

2. Faster Payments

Clients can pay directly through integrated payment gateways.

3. Professional Appearance

Customizable branding ensures your invoices look polished.

4. Accurate Financials

Automatic tax calculations and expense integration reduce errors.

5. Business Insights

Reports track late payers, top clients, and monthly income trends.

How to Choose the Best Invoice & Billing App

The best app depends on your needs:

- Freelancers: FreshBooks, Invoice2go, AND.CO.

- Small Businesses: Wave, Billdu, Zoho Invoice.

- Growing Companies: QuickBooks, Xero, Square.

- International Work: PayPal, Zoho Invoice.

Future of Invoice & Billing Apps

In 2025 and beyond, expect:

- AI Assistance: Predict payment delays and automate cash flow planning.

- Blockchain Security: Enhance trust in digital transactions.

- Voice Commands: Create invoices via smart assistants.

- Deeper Integrations: Links with CRMs, e-commerce, and banks.

Conclusion

Handling invoices and billing doesn’t have to be a stressful task. The top apps for invoice & billing in 2025 make it easier to create, send, and manage invoices while ensuring faster payments and professional interactions.

From free apps like Wave and Zoho Invoice to all-in-one platforms like QuickBooks and Xero, there’s a solution for every business size and type.

By adopting these tools, you’ll not only save time but also build stronger financial control, improve cash flow, and boost client satisfaction.