Tax season is one of the most dreaded times of the year for individuals and businesses alike. Between confusing forms, changing laws, and the constant fear of making mistakes, it can feel overwhelming. Thankfully, tax filing apps are making this process easier than ever. With automation, guided instructions, and direct links to IRS-approved e-filing systems, these apps simplify what used to take days into just hours. Whether you’re an employee with a single W-2 or a freelancer with multiple 1099s, there’s an app designed for your needs. Below, we explore the top apps for tax filing in 2025 and why they stand out.

1. TurboTax – The All-in-One Tax Giant

TurboTax remains the gold standard for tax filing in 2025. With its intuitive design, powerful tools, and personalized step-by-step guidance, it is often the first choice for individuals and businesses. TurboTax can automatically import W-2s and 1099s, ask interview-style questions to ensure deductions aren’t missed, and even offer live help from certified tax professionals. Its mobile and desktop versions sync seamlessly, so you can start your return on one device and finish on another. TurboTax also offers audit support, refund tracking, and maximum refund guarantees. This makes it ideal for those who want comprehensive tax help, from simple returns to complex business filings.

2. H&R Block – Expertise with Digital Convenience

H&R Block has successfully merged decades of tax preparation expertise with a modern, easy-to-use digital app. It allows users to upload tax documents by simply snapping a photo, making data entry painless. The app also connects you to live tax experts who can provide detailed guidance, ensuring accuracy and compliance. For users who like flexibility, H&R Block makes it easy to switch from other providers like TurboTax without losing data. With straightforward pricing and the option to visit physical offices if needed, H&R Block is the best of both worlds—digital convenience with real human support.

3. TaxSlayer – Affordable Filing for Everyone

TaxSlayer is known for offering one of the most affordable tax filing solutions on the market. Despite its lower pricing, it doesn’t compromise on essential features. The app supports multiple filing statuses, helps identify deductions and credits, and even provides free filing for military members. With a mobile-first design, it is easy to complete your entire return from a smartphone. TaxSlayer is perfect for individuals who want a powerful yet budget-friendly option without paying premium fees for features they don’t need.

4. FreeTaxUSA – Simple Returns at No Cost

FreeTaxUSA is popular for its promise of free federal tax filing for most tax situations. While state returns come at a minimal cost, the app still offers excellent value compared to competitors. It provides step-by-step guidance, error checks, and the option to upgrade for priority support. FreeTaxUSA shines for individuals with straightforward tax needs who want to file quickly and cheaply. It may not have all the premium bells and whistles, but it’s more than enough for simple cases.

5. Cash App Taxes – Truly Free Filing with Extra Perks

Formerly Credit Karma Tax, Cash App Taxes offers a completely free tax filing solution for both federal and state returns. What sets it apart is its integration with Cash App, allowing users to receive refunds directly into their Cash App accounts for instant access. It also includes free audit defense, making it one of the most generous no-cost solutions available. Cash App Taxes is best for anyone looking to file their taxes without paying a cent while still benefiting from modern features.

6. TaxAct – Professional Features at a Lower Cost

TaxAct strikes a balance between affordability and professional-grade features. It includes a powerful deduction finder, maximum refund guarantees, and the ability to import past returns for easy continuity. Its calculators and tax planning tools are especially useful for small businesses and individuals with more complex finances. Compared to TurboTax, TaxAct offers similar features at a lower cost, making it a strong alternative for budget-conscious filers who still want robust tools.

7. Jackson Hewitt Online – Flexible and Practical

Jackson Hewitt, known for its in-office tax services, now offers a solid online option. Its biggest advantage is flexible pricing with no hidden fees, and the ability to pay filing costs directly out of your refund. This removes the need for upfront payments, which is helpful for cash-strapped users. With a large library of tax tips and the backup of physical locations, Jackson Hewitt Online appeals to users who want flexibility, affordability, and the option to seek in-person help if needed.

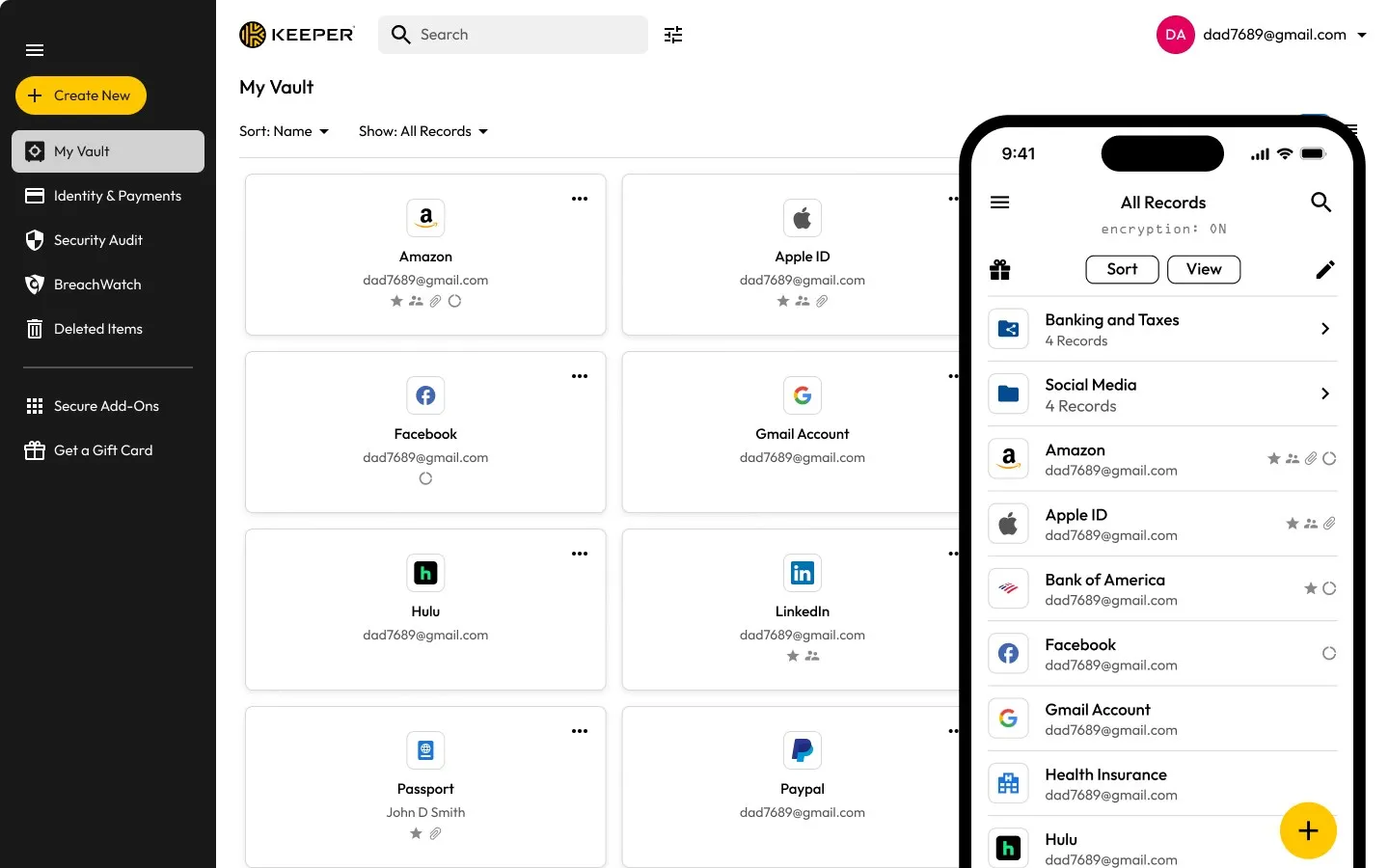

8. Keeper – Tailored for Freelancers and Gig Workers

Keeper is designed specifically for freelancers, gig workers, and independent contractors who often struggle with complex 1099 forms and deductions. The app uses AI to automatically track expenses, identify deductions, and keep organized records year-round. By the time tax season arrives, much of the heavy lifting is already done. With real-time bookkeeping and expert support, Keeper is the ultimate choice for anyone in the gig economy looking to reduce tax stress and maximize deductions.

9. E-File.com – Fast, Simple, and Affordable

E-File.com is ideal for users who want a simple and efficient tax filing experience. It provides fast form completion, low-cost filing options, and round-the-clock support. Unlike other apps with overwhelming menus and options, E-File.com keeps things straightforward, making it suitable for individuals who want to get their taxes done quickly without distraction. It is one of the most user-friendly IRS-authorized platforms for e-filing.

10. IRS Free File – Government-Backed Simplicity

For taxpayers who qualify, IRS Free File remains one of the most reliable cost-free options. Available to those under certain income thresholds, it is backed by IRS-approved providers and comes with step-by-step instructions. While it lacks the polish of commercial apps, it is fully secure and ensures compliance with federal requirements. IRS Free File is a good option for eligible taxpayers who don’t need premium features and want to file directly with a trusted government partner.

Benefits of Using Tax Filing Apps

Using tax filing apps in 2025 offers clear advantages. Automation saves hours of manual calculations. Built-in accuracy checks reduce the risk of errors and audits. Advanced apps help maximize deductions and credits, ensuring taxpayers don’t leave money on the table. Direct deposit integration speeds up refunds, while smart interfaces make the filing process less intimidating. Many apps now include live expert help, ensuring that even complex cases can be handled without stress. Overall, these apps bring convenience, accuracy, and peace of mind.

How to Choose the Right Tax Filing App

Choosing the best app depends on your specific needs. If your taxes are simple, free options like FreeTaxUSA or Cash App Taxes are perfect. If you’re self-employed, Keeper is built for your workflow. Businesses and freelancers with more complex returns may prefer TurboTax, H&R Block, or TaxAct. Budget-conscious users may choose TaxSlayer or E-File.com, while those who qualify can benefit from IRS Free File. Always consider cost, complexity, customer support, and extra features before making a choice.

The Future of Tax Filing Apps

Looking ahead, tax apps will only become smarter. Artificial intelligence will play a bigger role in predicting deductions and automating filings. Real-time tax tracking throughout the year will replace the last-minute rush of tax season. Blockchain technology promises enhanced data security, while global tax compliance tools will simplify cross-border filing for remote workers and international freelancers. The future of tax filing apps points toward more automation, stronger protection, and a smoother user experience for everyone.

Conclusion: Make Tax Season Stress-Free

Tax season no longer needs to be a nightmare. With the best tax filing apps in 2025, individuals and businesses can file quickly, accurately, and with far less stress. From premium leaders like TurboTax and H&R Block to completely free solutions like Cash App Taxes and FreeTaxUSA, there’s a perfect match for every taxpayer. Whether you’re a freelancer, a salaried employee, or a small business owner, these apps ensure you file confidently and get the most out of your return. Choosing the right one can make the difference between a stressful April and a smooth, stress-free tax season.